Too fierce! The 13 A-share brokers earned money last year in one quarter.

Zhongxin Jingwei Client May 3 (Dong Wenbo) As of the end of April, the financial reports of 35 A-share listed brokers in the first quarter of 2019 were all unveiled. On the whole, compared with the year of "falling into a dog" in 2018, it is not an exaggeration to describe the performance of brokers in the first quarter of this year as "vigorous".

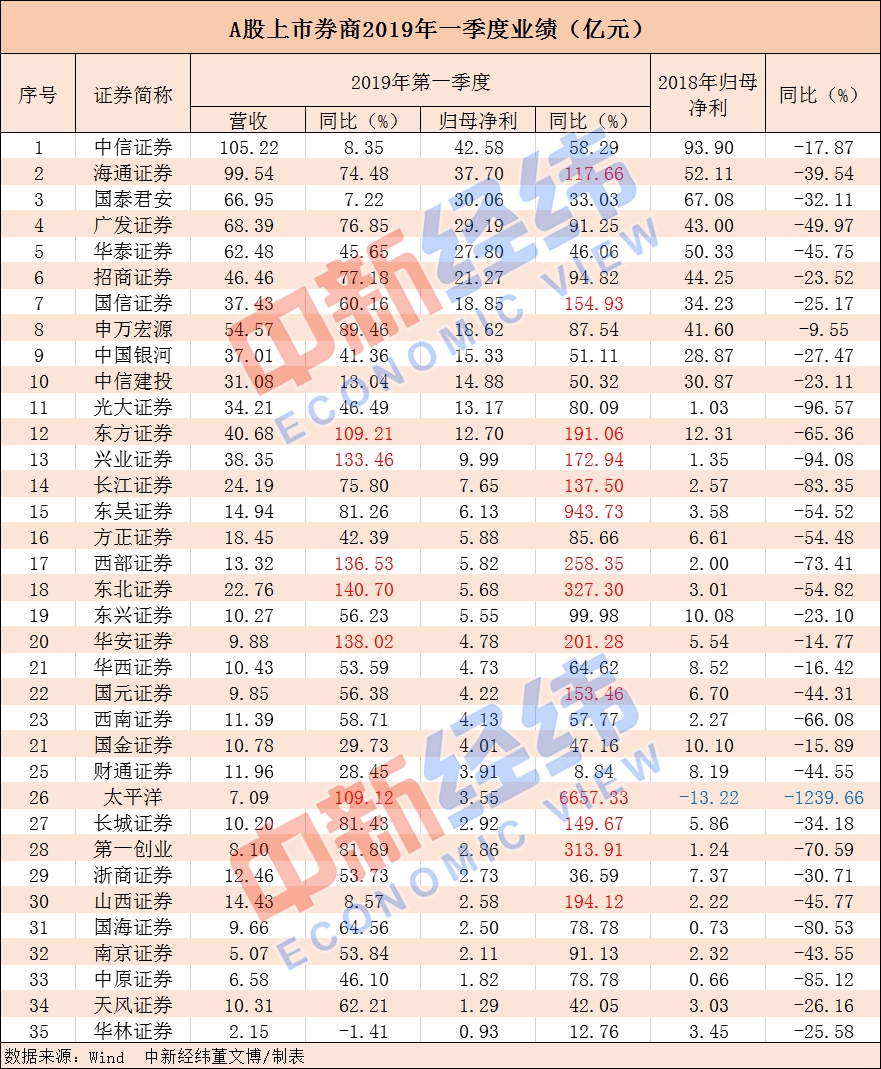

The Zhongxin Jingwei client combed and found that in the first quarter of this year, 35 A-share listed brokers realized a total operating income of 97.664 billion yuan, a year-on-year increase of 51.39%; The net profit attributable to shareholders of the parent company (hereinafter referred to as "net profit attributable to the mother") was 37.789 billion yuan, a year-on-year increase of 86.59%.

In the first quarter, the net profit of 14 brokers increased by more than 100% year-on-year

A shares have continued to rise since this year. From January to March, the Shanghai Composite Index climbed from 2,440.91 points to 3,129.94 points, with a cumulative increase of 23.93%. Wind theme industry brokerage index rose rapidly, with an increase of 67.39% in the first quarter. The hot A-shares also make the listed brokers who rely on the capital market to eat earn a lot of money.

The data shows that during the reporting period, the top 12 listed brokers all had a net profit of more than 1 billion yuan, and CITIC Securities, the leader, ranked first with 4.258 billion yuan, and was the only listed brokerage with a profit of more than 4 billion yuan in the first quarter. Haitong Securities and Guotai Junan ranked second and third with 3.77 billion yuan and 3.006 billion yuan respectively.

Judging from the year-on-year increase in the net profit of returning to the mother, all listed brokers achieved positive growth in the first quarter, which means that the profitability of listed brokers increased during the reporting period compared with the same period in 2018. Among them, 14 have increased by more than 100%, except for Haitong Securities and Guoxin Securities, the rest are small and medium-sized brokers;The most eye-catching increase is Pacific Securities. The net profit of 355 million yuan in the first quarter of this year increased by 6,657.33% compared with the profit of 05 million yuan in the first quarter of 2018!

In terms of operating income, during the reporting period, there was only one listed brokerage with revenue exceeding 10 billion, which was also CITIC Securities. Haitong Securities ranked second with revenue of 9.954 billion yuan; GF Securities surpassed Guotai Junan to rank among the top three, with revenue of 6.839 billion yuan in the first quarter.

Judging from the year-on-year growth rate of revenue, orient securities, Industrial Securities, Western Securities, Northeast Securities, Huaan Securities and Pacific Securities exceeded 100%. In addition, Hualin Securities achieved a revenue of 215 million yuan in the first quarter, a slight decrease of 1.41% compared with the same period in 2018, making it the only listed brokerage with a decline in revenue growth.

Contrast:

13 brokers lost their net profit last year to the first quarter of this year.

In stark contrast to the results in the first quarter, the performance of these 35 listed brokers collectively "fell" in 2018.

The data shows that in the whole year of 2018, A-share brokers realized a cumulative net profit of 58.378 billion yuan, and during the reporting period, the growth rate of net profit of all brokers declined collectively. With reference to ICBC, which earned 816 million yuan a day in 2018, 58.378 billion yuan can be earned back in 71.54 days!

CITIC Securities held the top spot, but its net profit returned to its mother fell by 17.87% year-on-year to 9.39 billion yuan. This means that last year, no listed brokerage company made a profit of more than one million.

The largest year-on-year decline in the net profit of returning to the mother was Pacific Securities, which suffered a huge loss of 1.322 billion yuan in 2018, down 1,239.66% year-on-year, and it was also the only listed brokerage with a loss in the same period.

Everbright Securities followed closely, and the net profit returned to the mother in 2018 decreased by 96.57% year-on-year. Everbright Securities said that in 2018, affected by the dual pressures of macroeconomic downturn and deep adjustment of the capital market, the development of the securities industry was struggling, and the industry showed obvious characteristics of stock competition or even reduced competition.

In comparison, the worst thing is that there are 13 listed brokers whose net profit for the whole year of 2018 is not as much as that in the first quarter of this year!Except Pacific Securities, the other 12 companies are Everbright Securities, orient securities, Industrial Securities, changjiang securities, soochow securities, Western Securities, Northeast Securities, Southwest Securities, First Venture, Shanxi Securities, Guohai Securities and central china securities.

Institution:

Optimistic about the investment value of the brokerage sector

In April, the A-share market maintained its adjustment. In 21 trading days, the Shanghai Composite Index closed 12 negative lines, and fell for 6 consecutive days from April 22 to April 29. On the last trading day of April (April 30), the Shanghai Composite Index closed up by 0.52%, but it did not stand at 3,100 points.

Shen Wanhongyuan pointed out that at present, the market is in a hot ebb tide, and new hot spots have not appeared. At the same time, after the favorable policies are cashed, the market has a strong wait-and-see mood. Based on comprehensive judgment, the market has entered an adjustment period in the short term, mainly to find the bottom and stabilize; The medium-term upward trend remains unchanged, and the post-holiday market is worth looking forward to.

As for the brokerage industry, Zhongtai Securities believes that thanks to the market recovery in the first quarter, the overall performance of brokerage firms is bright, science and technology innovation board’s acceptance and inquiry have been steadily advanced, the securities law has ushered in the third trial, and the capital market reform is expected to continue to promote the transformation and development of the brokerage industry. Under the background of increasing the importance of direct financing, the competitiveness of leading brokers is expected to continue to increase and continue to be optimistic.

Great Wall Securities also pointed out that science and technology innovation board is coming at full speed, and brokers play an important role. The financial+financial technology represented by brokers is an important main line of future capital, and we are firmly optimistic about the long-term investment value of the brokerage sector.

Minsheng Securities said that with the improvement of the market environment, the brokerage business and self-operated business of brokers will continue to improve, and the performance growth can be expected. The first batch of science and technology innovation board is expected to land in June-July, and the refinancing will continue to be loosened, which can directly bring about an increase in the investment banking business of securities firms. (Zhongxin Jingwei APP)